Grabbing the lead

In our remote work world, it’s becoming quite normal for many people to get so stuck at their computers that they barely leave their homes or offices.

Obviously, we real estate agents simply can’t afford to do that! We make a name for ourselves by getting out and getting in front of as many people as we can.

Lead generation is the most important thing we can do as agents, and we truly can never know which lead might deliver to our next client.

We know it’s not an easy process, but we always remind ourselves that it’s an odds game. The more people you meet, the better your chances. It’s just that simple.

So today, get out there… after you read this edition of The Blueprint, of course!

– James and David

Buyers stay on sidelines as listings tick up

Source: Redfin

In a surprising move, more homeowners are putting their homes on the market despite having very low mortgage rates. That’s one of the eyebrow-raising findings in Redfin’s latest market update. Here are some of the important takeaways:

-

New listings of U.S. homes for sale have ticked up 2% since the start of September, and listings haven’t fallen as much from summer to fall as they typically do.

-

Over the past four weeks, the total number of homes for sale is down 14% YoY, but that’s the smallest decline since July.

-

Mortgage-purchase applications moved up slightly this week, but they’re still near their lowest level in approximately 30 years

-

Redfin’s Homebuyer Demand Index, which measures tour requests and other early demand signals, dropped to its lowest level in nearly a year

Our take

Well, this came as a pleasant surprise to us. We are glad to see some sellers actually listing their homes, even though they have low mortgage rates. This just shows that we can use all the analytics we want, but ultimately, we can never predict what some people will do, and when buyers and sellers will stray from the norm. Even though it’s rare, it’s great to know the possibility is out there, so keep your eyes open and look to capitalize when it happens!

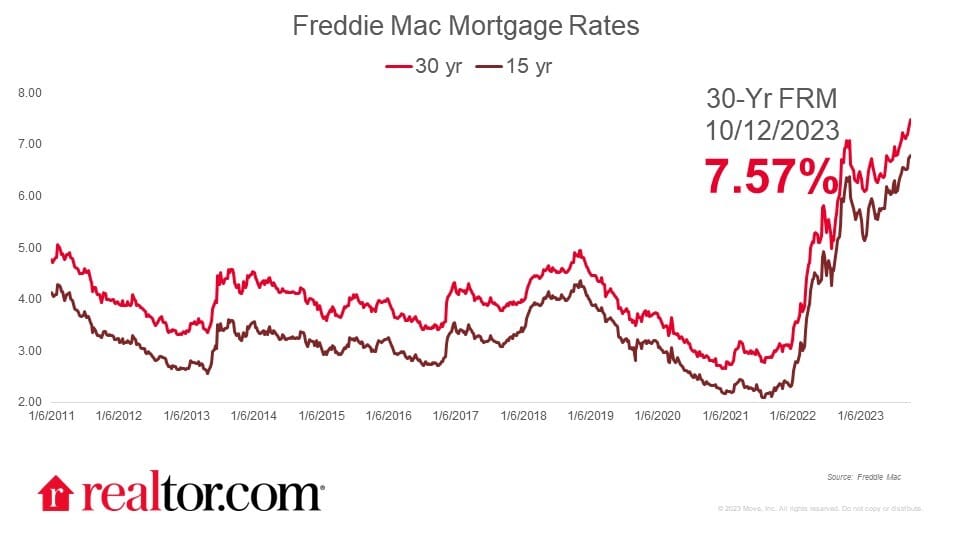

Adjustable-rate mortgage demand spiked last week

Source: Realtor.com

CNBC reports that the demand for adjustable-rate mortgages (ARMs) increased by 15% over the week. Here are the other key points:

-

Of all mortgage applications, the share of ARMs is up 9.2%, the highest share since November 2022

-

Applications to refinance a home loan inched up 0.3% from the previous week, but were 9% lower than the same week one year ago.

-

The average loan size is now at its lowest level since 2017, indicating that most of the sales activity is happening at the lower end of the market.

-

At the very high end, buyers tend to use all cash, and in the middle range, affordability has been hit so hard that the market is essentially frozen.

Our take

It doesn’t surprise us one bit that ARM applications are on the rise. Right now, ARMs are a full percentage point and a quarter below the 30-year fixed mortgage. If you can swing the down-payment requirements, and the financials make sense in your case, we’re not opposed to using ARMs. Make sure you refinance when rates go down and then lock in those lower rates. That’s a smart play right now with mortgage rates so high. As always, it’s good to let our clients know about all the various options out there, and which ones make sense for them.

U.S. foreclosures near pre-pandemic levels

Source: ATTOM

In Q3, foreclosures were up 28% from Q2 and 34% from a year ago. In total, there were 124,539 U.S. properties with foreclosure filings such as default notices, scheduled auctions or bank repossessions. Lenders also started the foreclosure process on 3% more properties than a year ago, nearly reaching pre-pandemic levels. This is all according to ATTOM’s latest Foreclosure Market Report.

|

Metros with the highest foreclosure rates

|

Metros where foreclosures are falling

|

Our take

We know the headline was a little jarring, but when you actually look at the numbers, there is no reason to think a foreclosure crisis is upon us. We’re not in an ‘08 world. Mortgage lenders have tightened their qualification standards to ensure only the strongest borrowers receive loans. Right now, there are more buyers than there are homes for sale. This should keep home prices strong and help prevent another crash.

Schematics

The news that just missed the cut

-

What’s the largest U.S. asset class (Hint: Not bonds or stocks)

-

Script to use with sellers and buyers this fall

-

The most influential C-suite leaders in residential real estate

-

Clever ways homebuyers are turning to family for help

-

Russ Weiner, after selling Rockstar Energy to Pepsi, became a home flipper

Foundation Plans

Advice from James and David to win the day

We all hunt for leads, but how do you convert those leads into closed deals? Here are three tips for boosting your conversion rate:

Learn what is important to your clients – One of the most common mistakes agents make is trying to sell clients on what the agents think is important. That’s a mistake. You need to learn what’s important to your clients. True success lies in the ability to understand, connect, and deliver solutions tailored to the unique needs of every individual client.

Be an attentive and careful listener – In this business, you can’t just be a good talker, you’ve also got to be a good listener. You need to understand that every one of your clients has a unique story. They have unique desires, and unique pain points. Make sure to listen to what your clients have to say, and use that knowledge to show them that you truly understand their wants and needs.

Take time to calmly ask questions – A study once showed that agents who ask questions and actively seek to understand their client’s needs saw a significant increase in their conversion rates. In some cases, the increase was as high as 20%. But this is not something that comes naturally. It takes time, dedication, and most importantly, practice.

To learn more, start here!

The 1% Blueprint

An on-demand course created by James & David

Discover our strategies and techniques to attract a stream of high-quality leads, propelling your real estate business to new heights of success.

For Blueprint subscribers, the course is 30% for a limited time. If you’d like to take our course to learn how to become the top 1% of your market click here!

Just in Case

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

That’s a wrap on this edition of The Blueprint!

Remember: each day is a gift and a new opportunity to lead the life you want and to become the person you want to be. The mistakes and missteps you’ve made in the past don’t define you. Live as intentionally as you can and be ruthlessly focused on the goals you’ve set out to achieve. You can do it!

Thanks for reading, and we’ll see you back here on Tuesday!

– James and David

![WAS [the newsletter] by Estate Media](https://estatemedia.co/wp-content/uploads/2024/10/was-the-newsletter-min.jpg)