Make every day count

We always want to make the most of every day, but that doesn’t mean we spent all day working.

In fact, we think that’s a recipe for burnout and frustration.

Part of making the most of every day is knowing when it’s time for a break.

I just got back from an incredible, much-needed vacation where I had the chance to clear my head, get out of the weeds for a bit, and remember why we do this.

Take care of yourself, take time to be with your family, and remember what matters most. Because when you do your best at work, you can have the best at home.

– James

Opendoor’s iBuying program gets fined

Source: Geekwire.com

Opendoor’s iBuying program over-promised and under-paid. Now the Federal Trade Commission is fining the company $62,000,000. Here’s what the FTC concluded:

-

Opendoor used deceptive marketing practices to mislead sellers into believing they could profit more by selling directly to Opendoor’s iBuying program than working with a traditional agent

-

These sellers often ended up paying more in Opendoor fees than they would have with an agent

-

Opendoor claimed to pay sellers a fair market price for their home, but tended to offer a price below market value

-

Opendoor will now be required to cease all deceptive marketing, and use the $62M fine to compensate the sellers they deceived

Our take

This story underscores the biggest problem with iBuying companies like Opendoor–they are built to serve their own bottom line, not your clients. When buyers and sellers work with an agent, they’re paying for direct, one-on-one, tailored service. They’re sitting down with an expert, going through the process step-by-step, and getting the best possible deal, no matter what side of the table they’re on. That’s why agents offer value that technology just can’t replace. Period.

How to explain mortgage rate activity in under 30 seconds

Source: Apartment Therapy

Last week, the Federal Reserve hiked interest rates another 0.75%. Surprisingly, mortgage rates actually fell over the next few days. Here’s why the relationship between interest rates and mortgage rates is more complex than usual:

-

Mortgage rates are influenced by a lot of factors, including inflation, supply and demand, individual lenders’ fees, and each buyer’s credit score and down payment.

-

As demand for refinances and mortgage products drops (as it has recently), lenders may reduce their rates to encourage activity. That’s what triggered the brief rate drop we saw last week.

-

Mortgage rates tend to follow bond yields more closely than interest rates, and lately, bond yields have been declining. However, economists don’t expect this trend to last much longer.

Our take

Whether or not we can officially label this a recession, we are certainly in an economic downturn. But like always, those who need to buy will continue to buy, and those who don’t need to buy, won’t. Either way, you can bet we’ll be available the moment they decide to move. In any economic climate, our goal is to be top of mind, one call away, and always ready to deliver. That should be your goal too!

Sellers cut prices in these 10 cities

Source: Kayak

Nationwide, sellers are cutting list prices on a record-setting number of homes in hopes of getting more buyers through the door. For the first time in more than two years, we’ve seen a drop in the share of homes selling above asking. But these trends aren’t impacting all markets equally.

According to Realtor.com, in July, these cities had the highest percentage of listing with price reductions:

-

Reno, NV – 32.6%

-

Austin, TX – 32.4%

-

Phoenix, AZ – 29.5%

-

Anchorage, AK – 28.5%

-

Boise, ID – 27.4%

-

Ogden, UT – 27.4%

-

Sacramento, CA – 25.2%

-

Colorado Springs, CO – 25.1%

-

Evansville, IN – 24.7%

-

Medford, OR – 23.2%

Our take

The market is just normalizing right now. Don’t let these price adjustment stories scare you away. But be aware of them, and act accordingly. That means preparing your sellers for potential price reductions, and making sure they understand time-on-market is increasing. It also means taking this opportunity to negotiate the best deals for buyers.

Schematics

The news that just missed the cut

Source: Bloomberg

-

Europe’s best cities for buying a vacation home

-

Zillow and Opendoor announce partnership

-

7 steps to build a $3.5M rental real estate portfolio

-

Flip tips from the stars of HGTV’s ‘Bargain Block’

-

These design trends are popping up everywhere

-

This report covers the top 2022 marketing trends you should know

Foundation Plans

Advice from James and David to win the day

You may be one of the top agents in your local market… but you don’t have to sound like one! Here’s how to drop the industry jargon and talk about market trends in a way that puts your clients’ minds at ease:

-

Don’t say “There’s nothing on the market right now.” That can be discouraging to buyers. First, relate to their fears and frustrations. Then remind them that inventory is available, it just isn’t sitting for long. They can still find an amazing and affordable property, if they’re willing to move quickly.

-

Avoid “This isn’t like the Crash of ‘08.” Remind your buyers why this market is so different. Stick to the core data. The reality is, in four of the past six recessions, home prices have actually appreciated. And they’re not dropping yet.

-

Resist the urge to say “Just refinance later!” Truthfully, rates may never be lower than they are now. Not only is this statement a little misleading, it overlooks a key fact: buyers should never commit to a monthly mortgage payment they can’t comfortably afford. And we shouldn’t ask them to!

If this advice was helpful, Broke Agent Media has a great article that covers these overused phrases and more. Check it out here!

Q&A

You ask, James and David answer!

Q: I recently got a huge referral. It's a buyer with a $10M budget. If this works out, they'll be the biggest client of my career! What's some advice you can give me to close this client and make sure I become his go-to-agent for future business?

A: Congratulations! That’s a major milestone. In short, you’ve got to show him why you’re the absolute best at your job. When you go into your pitch appointment, be completely prepared. Bring a list of potential showings, local data, a record of your past wins, and anything else you can show him that proves you're prepared to get him the home of his dreams. Show that buyer how you're getting creative at finding off-market listings. Make sure he knows you're working harder than the competition ever would. Communicate well and often. You've got this.

We’ll be back next week with another answer to a real reader question. Submit yours here!

Just in Case

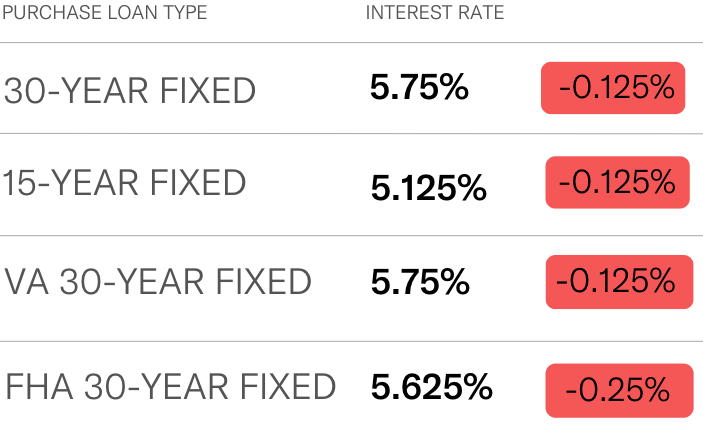

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Rocket Mortgage

If you've made it this far in the newsletter, you're a real one! So here is some insider information; we're launching a podcast on Monday morning, so be on the lookout.

Have a great weekend. We’ll see you on Tuesday!

– James and David

Was this forwarded to you? Sign up here.

Want to advertise in The Blueprint? Go here.

Want to submit a question to us? Submit here.

![WAS [the newsletter] by Estate Media](https://estatemedia.co/wp-content/uploads/2024/10/was-the-newsletter-min.jpg)