Start Now!

We know we’re not out of September yet, but we’re here to tell you it’s time to start prepping for 2024. As crazy as it may sound, you read us right!

Next year is going to be tough. Home costs and mortgage rates are mostly likely going to stay higher for longer. Deals aren’t going to come as easy. So it’s important to start laying the seeds now. We all know real estate deals don’t happen in an instant. They take time to develop and nurture, so it’s important to try to get a head start.

Look, we don’t want to sound like downers. We’re just trying to be realists! The road ahead may be bumpy, so it’s good to get ahead of the game.

That’s what we’re here to help you do.

Over the next quarter, we’re going to be doing everything we can to get you ready and in tip-top real estate shape for 2024. We want to help you get your business plan, your leads, your follow-ups, your system processes, your fitness, your energy, and your knowledge working like a well-oiled machine.

While this all may sound a tad stressful, let us remind you about the best part–we’ve still got more than 3 months before the end of the year, so let’s make the most of it!

– James and David

New listings tick up in August

Source: Keeping Current Matters

There was an unusual uptick between July and August in the number of newly listed homes, according to the latest data from Realtor.com. A peak this late in the year isn’t typical. In the graph above, you can see both the normal seasonal trend and the unusual August.

Our take

It’s still too early to say for sure if this trend will continue, but it’s something you’ll want to stay ahead of if it does. Remind your potential sellers: now may be the sweet spot. If this trend continues, that just means that any sellers who hesitate will face more competition. When housing inventory is this low, your house will stand out, especially if it’s priced right. If you sell now, you can beat your competitors to the punch.

Expect elevated mortgage rates throughout 2024

At its September meeting Wednesday, the Federal Reserve held interest rates steady, as expected, while acknowledging that the U.S. job market was slowing down. The Fed also indicated that it will make two other key moves:

-

The Fed expects to keep interest rates higher for longer than anticipated because it expects the economy to grow faster and unemployment to remain lower than it previously predicted.

-

The Fed raised interest-rate expectations for 2024 and 2025 by half a percentage point each, which is a major change in its projection. It expects to cut rates twice next year instead of four times as it previously forecasted.

Our take

Nothing came as much of a surprise on Wednesday. While these moves make total sense, we can’t say we’re not a little bummed. There is no way around it. Higher-than-anticipated interest rates in 2024 and 2025 will keep borrowing costs elevated. This will keep mortgage rates and housing costs higher for longer. Agents will need to prepare to handle this hurdle if they’re going to get any deals done next year.

Top U.S. housing markets least at-risk of declines

Source: ATTOM

Markets in the South and two New England states had the highest concentration of locales least likely to decline. That's the conclusion of ATTOM’s latest Housing Risk Report.

Based on various factors – such as the percentage of homes facing possible foreclosure, the portion with mortgage balances that exceeded estimated property values, and local unemployment rates – ATTOM determined the following markets to be the least at-risk of declines.

-

Chittenden County, VT

-

Benton County, AR

-

Fairfax County, VA

-

Prince William County, VA

-

Shelby County, AL

-

Cass County, ND

-

Middlesex County, MA

-

Brown County, WI

-

Rutherford County, TN

-

Sarpy County, NE

Our take

While there aren’t a lot of positive signs for next year, there is one good one–thankfully, there won’t be a crash of housing prices. Nationwide, prices should rise by about 4.9%. But that’s not true for every market. Some will see declines. So it’s vital that we agents use every source of intel to make our best bets on which markets will see price increases or drops. Keep an eye on this newsletter. We’re going to do everything we can to get you ready for the challenges we’re going to face in 2024.

Schematics

The news that just missed the cut

Sacramento: https://bit.ly/3EM9M2y

-

Register to our FREE ONLINE MASTERCLASS “The Road to $4 Billion”

-

Inside Patrick Mahomes’s real estate portfolio

-

NAR Accountability Project has now launched

-

Keep your pipeline full with these strategies

-

Social media platforms ranked for real estate agents

Foundation Plans

Advice from James and David to win the day

If you rely on just one source of leads (like referrals or one key developer relationship), you are putting your business at risk. But when you’ve got leads coming in from multiple sources, you’ve always got something to work with. Here are 6 great lead sources you need to tap into:

-

Farming leads – You can get a list of leads to farm from your title rep

-

Online – Including your website, social media, and paid ads

-

Referrals – Either from clients, other agents, or through professional connections

-

Expired listings – The MLS is full of these leads

-

Circle prospecting – This involves networking in the area where a home recently sold

-

For sale by owners – You can find them all over Zillow and other platforms

To learn how to maximize each of these lead flow channels, check out this video.

Just in Case

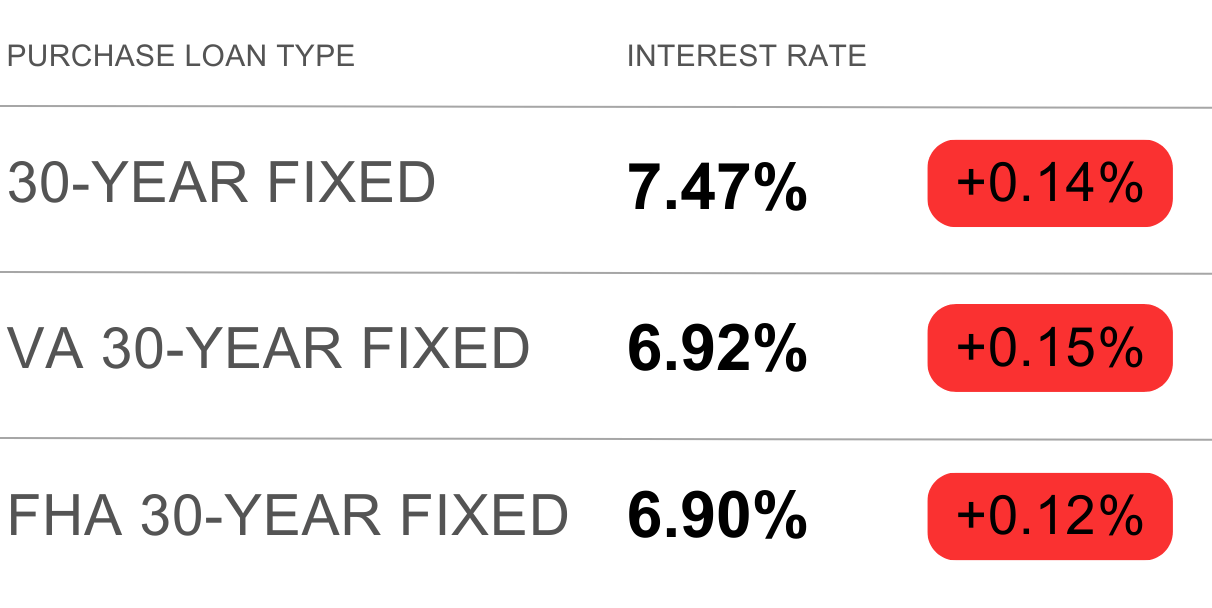

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Mortgage News Daily

That’s a wrap on this edition of The Blueprint!

Remember: each day is a gift and a new opportunity to lead the life you want and to become the person you want to be. The mistakes and missteps you’ve made in the past don’t define you. Live as intentionally as you can and be ruthlessly focused on the goals you’ve set out to achieve. You can do it!

Thanks for reading, and we’ll see you back here on Tuesday!

– James and David

![WAS [the newsletter] by Estate Media](https://estatemedia.co/wp-content/uploads/2024/10/was-the-newsletter-min.jpg)