It’s all about confidence

We knew from the minute we started doing real estate that we wanted to be in the luxury market. So from the start, we focused all of our efforts on reaching that high-end clientele.

Why didn’t we “practice” on smaller homes and work our way up? Because there’s no difference between selling a $1,000,000 house and selling a $10,000,000 house. All it is is an extra zero and a much nicer neighborhood. Really, if you can sell one home, you can sell any home! In fact, we’d actually argue that it’s easier to sell a high-priced home.

With bigger deals, you’re working with really savvy buyers who know what they’re talking about. They’ve bought and sold many homes before this one, so they don’t need nearly as much educating or hand-holding. At that point, it’s all about customer service and relationship management.

Really, the biggest difference between the starter home market and the luxury market? Your paycheck. So, if you’re selling a high-priced home and feel some extra jitters, just keep that in mind.

– James and David

How likely is a drop in home prices?

Source: Unsplash

At this point, all the big real estate firms (Zillow, Fannie Mae, etc.) still believe average home prices will continue rising this year. However, a handful of expensive markets just might be heading for a price decline in the near future. CoreLogic studied nearly 400 major metros and ranked them based on the likelihood of a local price drop.

Here are some of Core Logic’s findings:

-

65% of U.S. regional housing markets are “overvalued” including every major market in Arizona, Florida, and Texas

-

9% of regional markets are “undervalued”

-

Only 2% of markets are “elevated” and could see a price drop

-

Home prices are expected to rise 5% over the next 12 months, down from 19.8% over the previous 12 months

Our take

This isn’t the great news that many buyers want to see about price drops, but it does show that we might not see the same steep increases related to the pandemic. We know a level-off is coming, and this is a sign that it’s getting closer, if it’s not already happening. Some markets may experience it quicker than others, but this data is helpful to see what’s happening nationally.

A new kind of home-equity loan

Source: Unsplash

For buyers struggling to save enough for a strong down payment, there’s now another path to homeownership. HomePace, a startup in Utah, is considering offering homebuyers cash in exchange for a portion of their home’s future appreciation.

Within the next year, they plan to offer buyers up to 15% of their new home’s value in upfront cash that can be put towards the down payment. HomePace’s CEO Joe Cianciolo says this unique offering will allow the company to reach a whole new group of people–homebuyers who may otherwise be unable to afford the home they want.

Our take

Companies like HomePace are interesting. On one hand, if these programs help buyers get into a home, that’s positive. On the other hand, real estate is such a strong investment because of the great appreciation potential. When you give away that appreciation, real estate loses some of its value. Encourage your buyers to consider every opportunity, but always thoroughly research new products like this.

Are increasing mortgage rates good?

Source: Unsplash

The latest National Association of Realtors data shows that in March pending home sales dropped in every region except the Northeast. That marks five consecutive months of an overall decline in pending sales. Two key reasons for the drop: higher mortgage rates and sustained price appreciation. Year to year, mortgage payments are up 31% nationally, and in major Sun Belt metros such as Tampa, Phoenix and Las Vegas, that number is nearing 50%.

Our take

At first, the increase in mortgage payments may seem like bad news, but in reality, rates are still historically low. As we are watching the market unfold, we are seeing opportunities for buyers who have been missing out on deals whereby there have been 20+ competing offers on any given home. This will help you as an agent win deals for your clients without having them overpay. Get in touch with old buyers who may have been priced out of the market throughout the past year and win them their home!

Schematics

The news that just missed the cut

Source: LA Times

-

Disney’s former CEO just listed this property for $225M

-

The debate over real estate as an inflation hedge

-

Comparing the costs of buying vs. building

-

7 issues you can’t ignore when buying a home “as-is”

-

Research these 10 things before your buyer makes an offer

-

The best cities for beach house rentals

-

Great infographic on the housing market over the last 40 years

Foundation Plans

Advice from James and David to win the day

How much is your real estate book of business really worth? Even if you aren’t looking to leave real estate anytime soon, it’s important to keep track of this number as part of your yearly growth goals. When valuing your business, make sure to consider these factors:

-

Expenses and deductions. Your expenses include all the money you have to spend to operate, like gas and marketing costs. You’ll also want to deduct any unusual revenue that didn’t come from regular operations, like cash from the Paycheck Protection Program, because this income didn’t technically come from your book of business.

-

Your discretionary earnings. Basically, how much cash do you bring in from normal business activities after you subtract expenses and deductions? The higher this number, the more valuable your business.

-

Your add backs. These are personal expenses that your business covered, like car maintenance or health insurance. They can be added back into your business as profit, boosting its value.

For more details about how to value your book of business, check out RealTrends full report here.

Just in Case

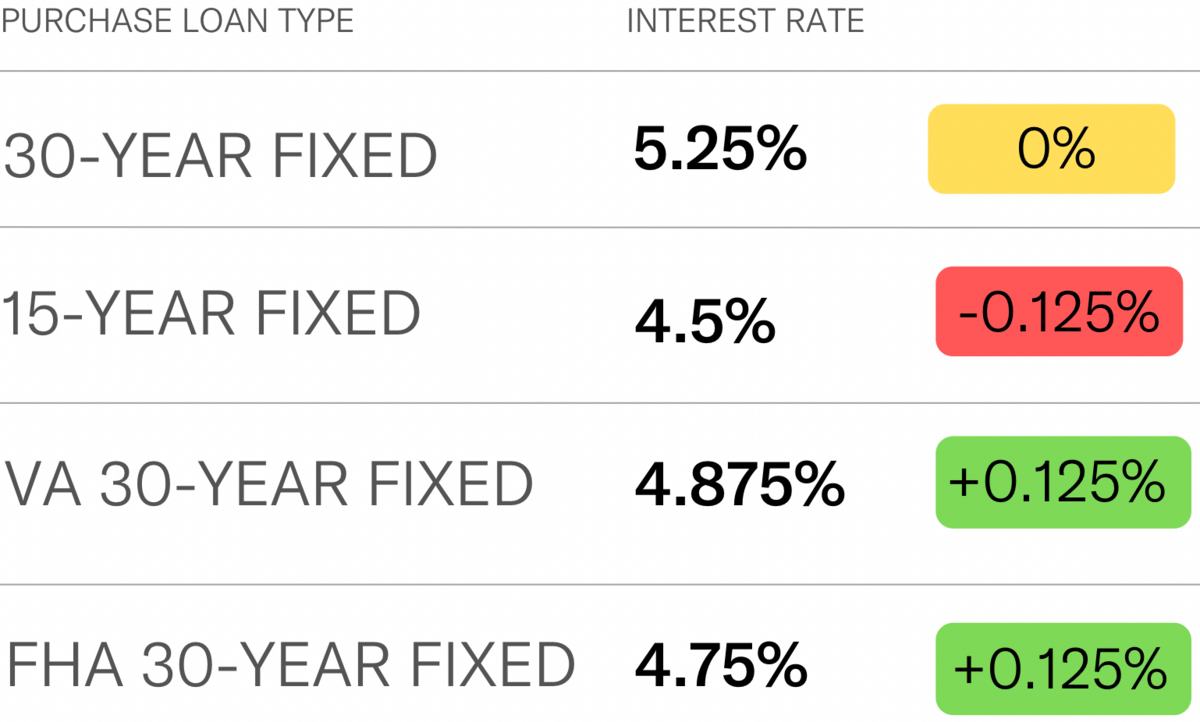

Keep the latest industry data in your back pocket with today’s mortgage rates:

Source: Rocket Mortgage

If you've recently subscribed to The Blueprint, let us know what you think. Hit reply to this email and we will definitely see it. We are dedicated to making the real estate community better, together.

See you Friday morning.

– James and David

Was this forwarded to you? Sign up here.

Want to advertise in The Blueprint? Go here.

Want to submit a question to us? Submit here.

![WAS [the newsletter] by Estate Media](https://estatemedia.co/wp-content/uploads/2024/10/was-the-newsletter-min.jpg)